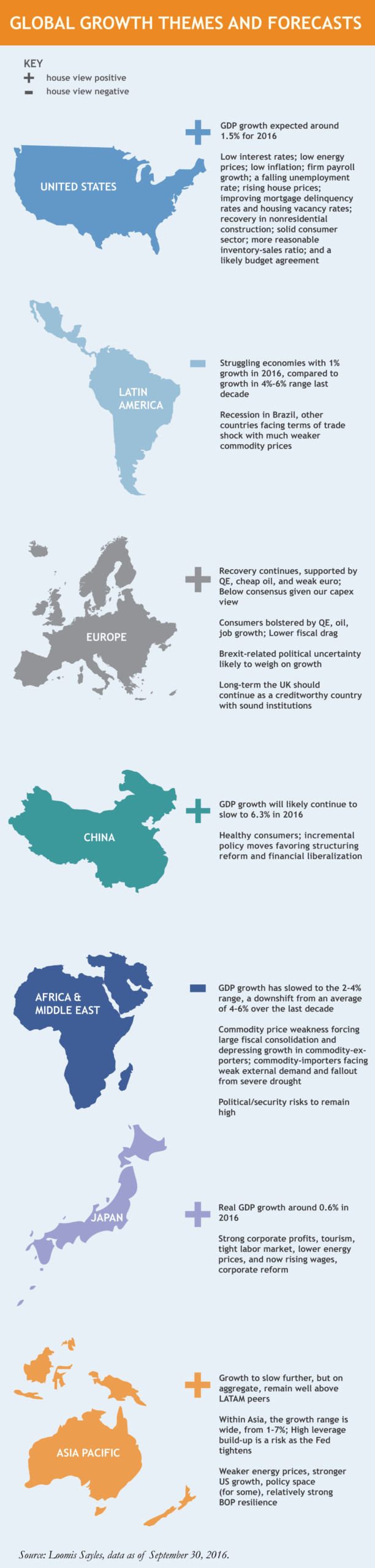

Global Growth Themes and Forecast (Infographic)

With global savings and investment having peaked recently, we remain in a demand deficient world, looking for the next region, country or sector to increase borrowing and spending. Until then, demand will likely fall short, and we’ll muddle through.

In this environment, markets have performed well, maybe too well, driven by financial repression and the thirst for yield. We’re in a “lower for longer” bond yield environment as inflation in advanced economies decelerates and major central banks—the Bank of England, European Central Bank and Bank of Japan—pursue quantitative easing (QE). The search for yield has pushed investment flows toward riskier assets such as high yield and emerging markets (EM). Spreads have tightened and stocks have done well. But we fear markets may be disappointed if we miss 3% global GDP growth expectations and S&P 500® Index operating profits rebounding by 10% to 13% in 2017.

We need economic execution and an exit from the profits recession to justify the recent rally in risk assets. If we’re right, and EM growth is bottoming while developed market growth is steady, then market valuations should eventually line up. Every quarter, we update our forecast map.

Read on for our global highlights:

MALR016043