2026 Global Bond Credit Outlook: Q&A

1. How are the fundamentals shaping up for European investment grade (IG) credit this year?

The fundamentals remain quite solid in early 2026, despite some recent moderate deterioration. We estimate that EBITDA growth for European companies has contracted by about 2% year over year. Leverage has ticked up, but it’s still sitting comfortably in the middle of its 10-year range.1 Interestingly, interest coverage ratios seem to have stabilized, which suggests companies have adapted well to market conditions and, in our view, will likely continue to do so. On the ratings front, things are looking up, especially after upgrades in major European economies like Spain and Italy. Overall, the European IG space is holding its ground with a relatively resilient profile.

The consensus earnings estimate for the sector is fairly optimistic for 2026, pointing to a sharp rebound in earnings in Europe underpinned by German fiscal spending, less tariff uncertainty, an improving backdrop in China and potentially easier financing conditions. This anticipated recovery is a bright spot for credit fundamentals, potentially supporting stable-to-improving credit metrics if realized, in our view.

2. Have spreads and yields shown much movement recently, and what does that mean for investors?

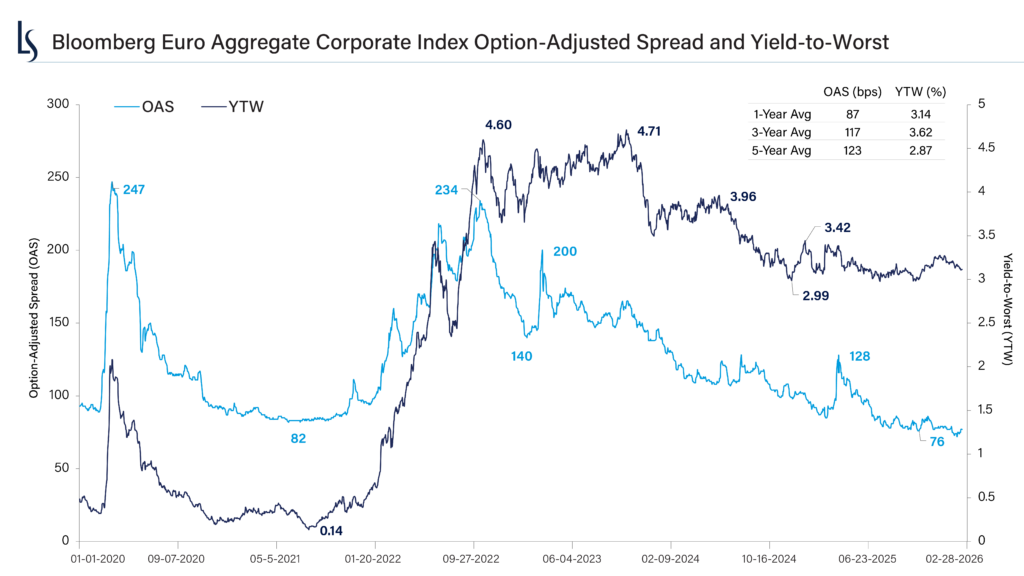

After moving sideways into year end, spreads have continued to compress with the Bloomberg Euro Aggregate Corporate Index (EUR) option-adjusted spread (OAS) reaching new tight levels in January 2026. On a 5-year lookback, the EUR OAS is near the zero percentile, suggesting spreads are historically tight, but on the other hand, yields have remained range bound since the fourth quarter of 2024 and rank at the fortieth percentile on the same lookback. The key takeaway is that relative value versus cash has remained appealing, particularly if the European Central Bank holds rates steady. Investors should keep an eye on central bank decisions, as these could shift the balance of risk and reward, in our view.

Source: Used with permission from Bloomberg Finance L.P., as of February 16, 2026.

The charts presented above are shown for illustrative purposes only. Some or all of the information shown may be dated, and, therefore, should not be the basis to purchase or sell any securities. The information is not intended to represent any actual portfolio managed by Loomis Sayles.

3. What about the shape of the yield curve?

Since spreads are historically tight, we believe carry and rolldown will likely be the main drivers of return in EUR credit. After the recent flattening at the front end of the EUR yield curve, the two-to-five-year segment looks fair-to-modestly more compelling than the five-to-ten-year space, in our view. The long end of the curve remains attractive for those willing to extend duration and we believe it could provide a decent risk/reward tradeoff for long-term investors.

4. What are your views on ratings dispersion and relative value across credit tiers?

Subordinated debt continues to trade at historically low spreads relative to senior debt, and corporate spreads only offer a small spread pickup versus higher-quality parts of the credit market, such as covered bonds and agency debt. From a ratings perspective, although high yield spreads saw some decompression in the fourth quarter of 2025 between the BB and B cohorts, the ratings pickup within IG was relatively stable and remains near historical lows.

While idiosyncratic risks have become more prevalent, rating dispersion remains limited, suggesting that the market is still pricing risk in a fairly uniform way. However, we believe investors should stay alert to company-specific developments that could break this trend.

5. How are the demand and supply dynamics shaping up for 2026?

European credit experienced very strong demand in 2025, with unprecedented inflows into short-term investment grade funds. While the pace of inflows has moderated recently, we believe demand for European credit should remain healthy. Ongoing launches of fixed-maturity funds and steady interest from insurance and pension investors, particularly as rate volatility remains subdued, should be supportive. EUR credit should also benefit from long-term tailwinds such as Dutch pension reform and a progressive redirection of international flows away from US-dollar-denominated assets and US-related risk, in our view.

Supply is expected to increase from what was already a record issuance year in 2025, driven by more debt-funded mergers and acquisition (M&A) transactions, substantial data center financing from US hyperscalers and corporates seeking to build cash buffers. However, we believe that the uptick in gross supply should coincide with a significant rise in 2026 maturities, keeping net supply at relatively modest levels.

6. What trends are we seeing in European M&A capital expenditures and share buybacks, and what do they signal for the credit cycle compared to the US?

When we look at indicators like M&A activity, capital expenditures and share buybacks, all three suggest that Europe is still earlier in the expansion phase of its credit cycle compared to the US. This implies that credit fundamentals are currently in better shape in Europe versus the US. Depending on how the macro environment evolves, it could leave plenty of room for an acceleration of capital deployment in Europe. For global credit investors, this could mean more opportunities and potentially more volatility as Europe catches up to the US in this cycle, in our view.

Endnote

1 EBITDA: earnings before interest, taxes, depreciation and amortization.

8761158.1.1

Market conditions are extremely fluid and change frequently.

This blog post is provided for informational purposes only and should not be construed as investment advice. Any opinions or forecasts contained herein reflect the subjective judgments and assumptions of the authors only and do not necessarily reflect the views of Loomis, Sayles & Company, L.P. Information, including that obtained from outside sources, is believed to be correct, but Loomis Sayles cannot guarantee its accuracy. This material cannot be copied, reproduced or redistributed without authorization. This information is subject to change at any time without notice